36+ debt to income ratios for mortgages

Ideally lenders prefer a debt-to-income ratio. Web Lenders view a DTI under 36 as good meaning they think you can manage your current debt payments and handle taking on an additional loan.

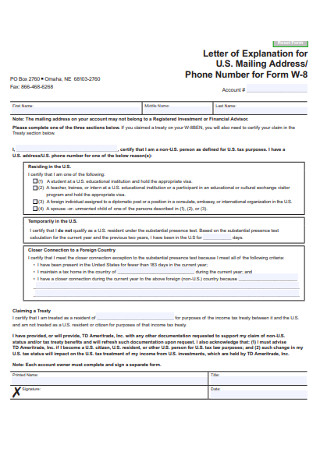

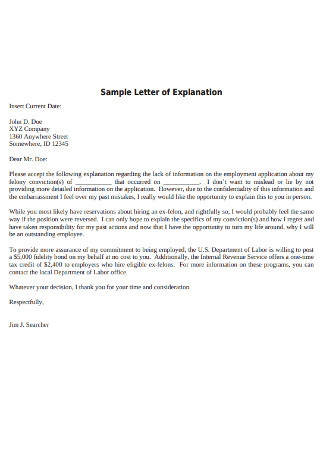

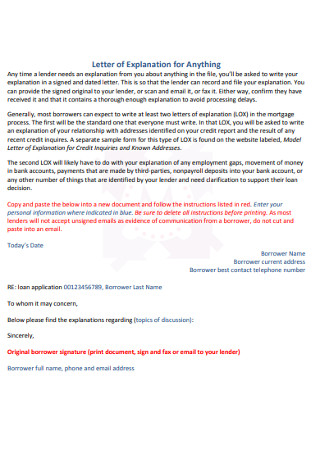

36 Sample Letter Of Explanation Templates In Pdf Ms Word

DTI between 3643 In this.

. Web What is a debt-to-income ratio. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web Generally a good debt-to-income ratio is around 36 or less and not higher than 43.

Find A Lender That Offers Great Service. Start Your Online Process Today. Total debt 900 300 1200.

This includes revolving credit such as credit cards and other lines of. Many lenders may even want to see a DTI thats closer to. Web How to Calculate Debt-to-Income Ratio.

You have to divide total. The rule says that no more than 28 of your gross monthly income. Is a Reverse Mortgage Right for You.

Highest Satisfaction for Mortgage Origination. Ad Compare Loans Calculate Payments - All Online. Mortgage lenders use debt-to-income ratio or DTI to compare your monthly debt payments to your gross monthly income.

Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less. Heres how lenders typically view DTI. To calculate your debt-to-income ratio first add up your monthly bills such as rent or monthly mortgage payments.

Apply Online To Enjoy A Service. Increase The Value Of Your House WIth a Second Mortgage. Check How Much Home Loan You Can Afford.

Lenders prefer you spend 28 or less of your gross monthly income on. Web For example if your monthly debt equals 2500 and your gross monthly income is 7000 your DTI ratio is about 36 percent. Knowing total debt you can calculate the back-end ratio.

Ad Calculate Your Payment with 0 Down. Web Homebuyers I cannot stress enough the importance of your Debt-to-Income DTI ratioYour DTI is a crucial factor in determining whether you qualify for a mo. 1 2 For example.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. But each mortgage lender can set its own eligibility Get the Most useful Homework explanation. Ad Compare More Than Just Rates.

Ad Our Team of Specialists Can Help You Determine if a Reverse Mortgage is Right for You. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Use a DSCR loan to purchase investment property without using personal income to qualify.

Ad Compare Find the 10 Best Pre Approval Mortgage In US. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ask Us Your Questions to Find Out Today.

Ad Use Your Home Equity Increase Your Home Value. What factors make up a DTI. A borrower with rent of 1200 a car payment of 300 a minimum credit card payment of 200 and a gross monthly income of 6000 has a debt.

Web Heres an example. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Apply Easily Save.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Ad Get Instantly Matched With Your Ideal Mortgage Lender. Compare Now Find The Lowest Rate.

Lock Rates Before Next Rate Hike. Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses. Ad NASB is a Debt Service Coverage Ratio mortgage lender.

Web So add the car loan to the mortgage payment. Use a DSCR loan to purchase investment property without using personal income to qualify. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

Web To calculate your debt-to-income ratio start by adding up all your monthly debt obligations. Ad NASB is a Debt Service Coverage Ratio mortgage lender. Compare Mortgage Lenders And Find Out Which One Suits You Best.

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Report On The Living Conditions Of Roma Households In Slovakia 2010 By United Nations Development Programme Issuu

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

What Is The 28 36 Rule Of Thumb For Mortgages

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Jpmc2016idexhibit991

What Is The Debt To Income Ratio Learn More Citizens Bank

What Debt To Income Ratio Is Needed For A Mortgage Tally

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Get A Mortgage Home Loan Tips

Application Requirements Formatic Property Management

Debt To Income Ratio To Be Able To Qualify For A Mortgage

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Mortgage Income Requirements In 2015 Influenced By Government Rules